How to Save Money: 12 Tips That Can Work for Anyone

“A penny saved is a penny earned”. Some attribute this saying to Benjamin Franklin, although he never wrote this exact sentence. But no matter who said it first, the sentiment behind it has been true for centuries and it’s still true now. Saving money is an important skill that you need to master if you want to gain your financial freedom or get into investing. So in this post, I’m going to give you some tips on how to save money.

Earlier, we talked about financial lifestyle. Now we’re going to talk about a way you can change yours. So if you want to learn some real and simple ways to save money, read on.

1. Track spending and income

The first step when you want to start saving money, is tracking expenditure and income.

Tracking income will be easy for most people but contract workers and freelancer may need to do some calculating to get a realistic estimate of their average monthly income, especially if they have some off months with almost no works.

Tracking expenditure will be a bit harder. But you should look at your bank statements and receipts and make a list of all your expenses. If you use cash often, you should write down everything you pay for immediately so that you don’t forget anything. Use your phone or a notebook to keep track.

For most people, doing this for a couple of months will work. But if you spend a vastly different amount every month and have few fixed expenses, you may want to track your spending for a longer period of time to get a more realistic average number.

Use any method you think will work best for you but get a real estimate on how much money you spend every month and know what you’re paying for. Just making this list can give you some ideas on how to save money.

2. Determine your priorities

Everyone wants (and needs) money! But ask yourself what you want to do with your money? There will be some essential expenses like paying the rent or paying for food. But after that, what do you prefer to do with your money? Paying for a weekend away or eating out more often or just saving for a rainy day? Make a list.

You should know what you want for the next tip to work. You can have some short-term and some long-term priorities and goals.

3. Make a budget

Now that you know how much you make, how much you spend and what you want to do, it’s time to make a budget! Here’s how:

Start with your fixed monthly expenses like rent, groceries, utilities and transportation. You should have a fairly accurate number for these, if you’ve followed the first tip. Subtract the sum of your fixed expenses from your average monthly income. How much is left? What percentage?

If the remaining amount is too low, you may want to start on some ideas to reduce your fixed expenses. (see tips number 7 and 12) But if it’s something you can work with, go back to your expenses list and priorities list and see how much you want to spend on what.

Group related expenses together and write down how much of your income you want to spend on them. Write a number that you can actually hold yourself to.

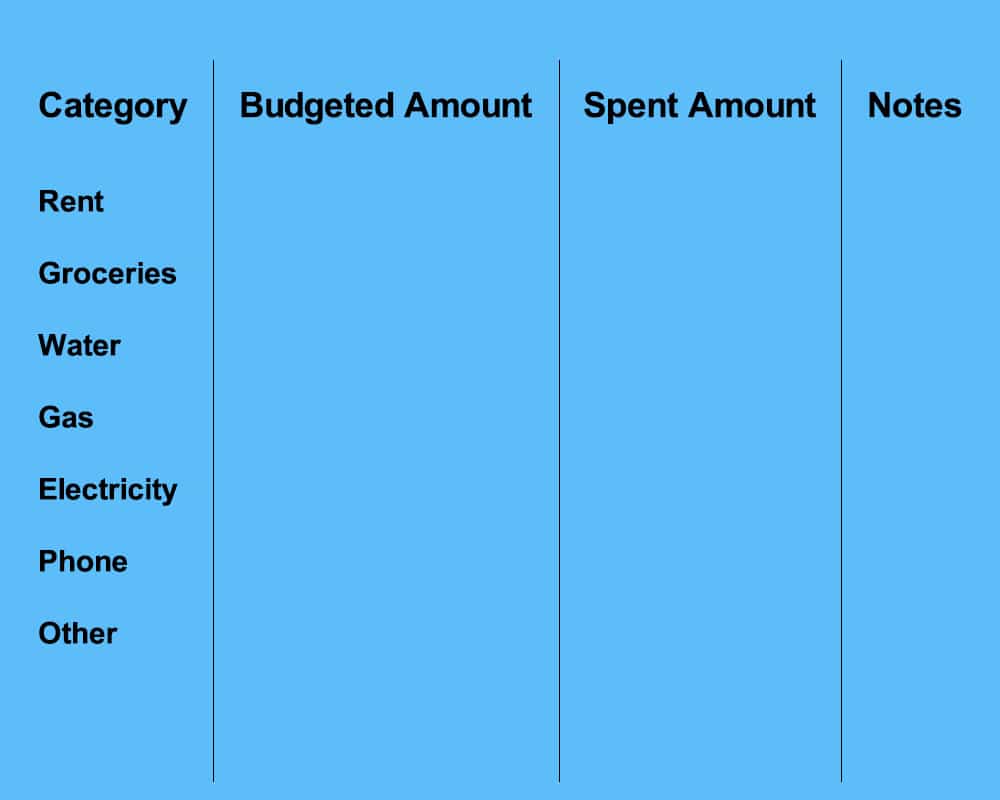

Your budget would probably look like this:

Remember that this is just one method. Do some more research and see some budget templates if you want more ideas.

4. Set saving goals

If you did your budgeting right, you should have a goal already. After all the expenses in your budget, how much of your income remained? This number can be a start.

But you should go back to your priorities list and if there are things on it that need more saving, you can set a more aggressive goal.

Either way, you should know how much money you want to save each month. If you want a guideline, 20 percent of your income is a good target to aspire to.

5. Open a savings account

Once you know how much you want to save, you should open a separate account for your savings. Many people think that they can keep some money in the account they regularly use. But this never works. You will usually spend everything you have in your regular account. So if you want to achieve your saving goals, having a separate account is a must.

It doesn’t even have to be a bank account. But your savings should be kept separate from everything else. For example, I have chosen to save money in the crypto format and I have a separate wallet for my long-term investments and savings.

Every time you get a paycheck, deposit the amount you want to save, to your savings account. Don’t wait for the end of month. Do it as soon as you can.

6. Decide what you’re going to do with your savings

After you’ve started saving, let at least a few months pass. But after your savings account grows to a good number, go back to your priorities list, look at the long-term goals and decide what you’re going to do with you savings. For example, how much will you keep in the account and how much will you invest and on what?

7. Think about your food

Paying for food will always be one of your biggest expenses. But if you think you’re spending too much on it or if you’re looking for a way to reduce your fixed costs, go through your spending list and see how you’re spending your food money. How many times a month do you eat out? How many time do you cook and stay home?

If you’re going out too many times, you can start to consciously cut back. And if you want to reduce costs for your at-home meals, you should see the next tip.

But whatever you do, don’t cut back on nutrition just to save money. Not eating right just to save a couple of bucks is just stupid and you will pay for it in the long run.

8. Shop responsibly with a list

Every time you want to shop for groceries or anything else, prepare a shopping list beforehand. Then go where you want to shop and stick to your list. Don’t buy anything else and don’t go window-shopping either.

Whenever you go out to buy something you need, you’ll see a bunch of stuff that you like or want. And that’s how shopping sprees get started. So do yourself and your wallet a favor and shop responsibly with a list.

9. Look for the best deals, not cheap products

It’s tempting to buy the cheapest options of everything you need when you’re trying to save more money. But buying cheap products will be costlier in the long run, especially in the more expensive categories like electronics.

When you want to buy something, look for the best options you can afford. Then see if you can find any deals on them. Maybe there’s a holiday coming and many online shops and local stores will have sales soon. Or maybe a new model of the thing you want to buy will hit the market in a couple of months. Wait if you can and try to buy the best possible option with the best possible price.

10. Think like a minimalist

According to the minimalist lifestyle, you should only buy and keep two kinds of things: first, the things that you really need and second, the things that spark joy for you. So every time that you’re about to spend some money, ask yourself if the thing you want to buy falls into one these categories. If not, you can probably reconsider this purchase.

11. Wait before making big purchases

If you think you’re sure that you want something, think again! Every time you want to make some big purchase, hold off on the idea for a bit. This waiting period should be at least 24 hours. If you’re not sure after a day, make it a week. And if you’re not sure by then, wait for a whole month.

After a month, ask yourself if you’ve really needed the thing you wanted to buy in the last 30 days or so. If not, you can probably hold off indefinitely.

12. Reduce your rent if you can

For people who are not home-owners, the cost of rent is the biggest fixed expense they have. So if your fixed expenses are too much or if you want to try and save more money, you can consider reducing your rent.

How? You can move to a cheaper neighborhood or get a room-mate. There aren’t many different ways to do this and it won’t be easy. But it’s doable if you want it.

Bonus tip: Beware of the poverty mentality

If you always obsess over saving a few more bucks, your brain will start to believe that you don’t have enough money and you never will. This belief will cause something called poverty mentality.

People with poverty mentality always live in fear. This fear not only prevents them from enjoying their life but also makes them poor decision makers, especially in the realm of personal finance.

They feel guilty when they buy something, they’re always afraid of spending or losing too much money, they constantly think about money and they hate rich people and want to become them at the same time.

If you see these characteristics in yourself, you should start thinking about making some changes in your life.

Pin It!

Your turn

Did you find these tips helpful? How do you save money? Let us know in the comments below.

Share this post with your friends and on social media.

***Last Updated on 21 March 2022 by Hamed Derakhshani (Guy with a Wallet)